The Government of Kerala has taken a commendable step towards uplifting the economically weaker sections of society through its Sevana Pension schemes. Launched in 2023, these schemes aim to provide comprehensive financial assistance and autonomy to marginalized segments. In this article, we delve into the intricacies of Sevana Pension 2024 , shedding light on its objectives, benefits, eligibility criteria, application process, and more.

Sevana Pension 2024

Sevana Pension Scheme 2024 is a pioneering initiative by the Kerala government to extend vital financial support to various disadvantaged categories. Through this initiative, pensions are disbursed across different sectors, aiming to diminish reliance on external aid for daily sustenance. The scheme’s beneficiaries encompass agricultural laborers, elderly citizens, individuals with disabilities, unmarried women above 50 years of age, and widows. It’s noteworthy that the Sevana Pension Scheme is administered jointly by the Department of Social Welfare and the Department of Labor in Kerala.

Diverse Pension Types

The Sevana Pension Scheme encompasses five distinct pension categories, each catering to a specific demographic:

- Agricultural Worker’s Pension

- Indira Gandhi National Old-Age Pension

- Indira Gandhi National Disability Pension Scheme (Mentally/Physically Challenged)

- Pension for Unmarried Women above 50 Years of Age

- Indira Gandhi National Widow Pension Scheme

Fulfilling Objectives

The core objective of Sevana Pension is to provide a reliable financial foundation for Kerala residents in need. By granting pensions, the scheme aims to foster self-sufficiency and alleviate the dependence of beneficiaries on external aid. The scheme facilitates diverse pension offerings, each tailored to address the unique needs of different demographics, ensuring a comprehensive safety net. Also read – PM Fasal Bima Yojana

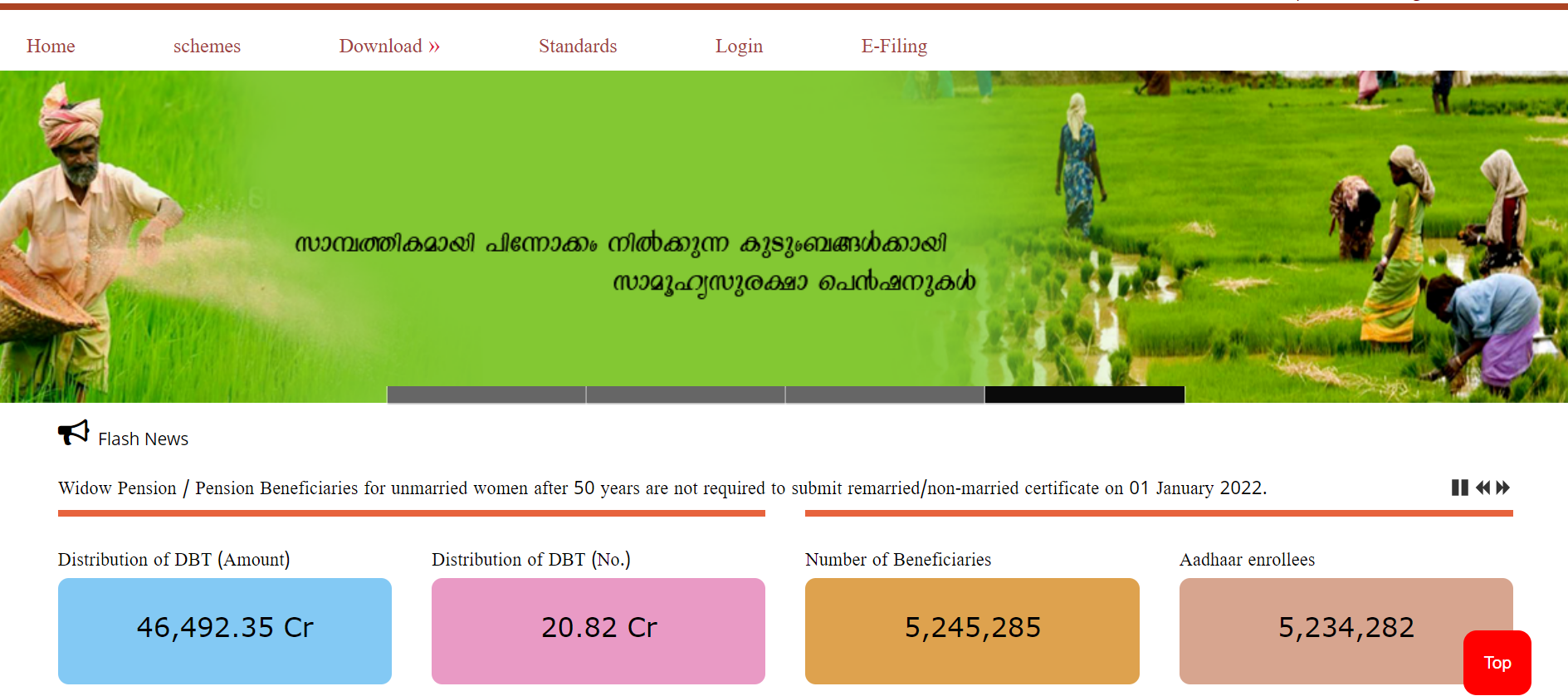

Statistical Overview

As of the latest data, Sevana Pension has made a significant impact:

- Total DBT Distribution Amount: ₹30,734.94 crore

- Total DBT Distribution Count: 12.57 crore

- Beneficiary Count: 4,868,137

- Registered Aadhar Recipients: 4,849,262

Benefits and Features

The Sevana Pension Scheme is characterized by its salient features:

- Initiated by the Kerala government

- Offers financial assistance to various societal segments

- Reduces dependence on external assistance

- Encompasses agricultural laborers, elderly citizens, disabled individuals, unmarried women above 50 years, and widows

- Administered by the Department of Social Welfare and the Department of Labor

- Five distinct pension categories available

- Convenient online and offline application modes

- Monthly pension amount set at ₹1500

Agricultural Worker Pension

Designed for laborers engaged in agricultural pursuits, the Agricultural Worker Pension provides crucial financial aid. Initially managed by the Kerala Department of Labor, it has been transferred to local governments in line with revised regulations. Applications are processed by local bodies, ensuring timely disbursement to beneficiaries.

Indira Gandhi National Old-Age Pension

The Indira Gandhi National Old-Age Pension Scheme supports elderly citizens lacking adequate financial resources. Formerly overseen by the Department of Social Welfare, its administration now rests with local governments. Municipalities and corporations accept, process, and disburse pensions to beneficiaries after necessary verification, aiming to bolster financial security for the elderly.

Indira Gandhi National Disability Pension Scheme

This scheme caters to physically or mentally challenged individuals without adequate financial backing. Beneficiaries with over 40% disability are eligible, with local governments, Gram Panchayats, and municipalities handling applications and pension disbursement.

Pension for Unmarried Women above 50 Years of Age

Addressing the financial needs of unmarried women over 50, this pension scheme empowers this demographic to meet their daily requirements. It’s important to note that taxpayers and individuals possessing significant property holdings are excluded. The state government oversees the scheme, ensuring seamless pension delivery.

Indira Gandhi National Widow Pension Scheme

Supporting widowed women without reliable financial assistance, the Indira Gandhi National Widow Pension Scheme aids them in overcoming financial challenges. Local governments manage the scheme, processing applications and pension distribution, thus providing a safety net for widows.

Eligibility Criteria

To avail of Sevana Pension benefits, certain eligibility conditions must be met. The table below outlines the criteria for each pension category:

| Name of Pensioner | Amount | Eligibility Criteria |

|---|---|---|

| Agricultural Worker Pension | ₹1500 | – Family income ≤ ₹1 lakh – Age ≥ 60 years – Not a service pensioner – Kerala resident for ≥ 10 years – Not an income tax payer – Agricultural laborer for ≥ 10 years – Landholding ≤ 2 acres – Not owning a 4-wheeler – Member of agriculture worker welfare fund – Not receiving other pensions |

| Indira Gandhi National Old Age Pension | ₹1500 | – Property ≤ 2 acres – Family income ≤ ₹1 lakh – Not a service pensioner – No other protection – Not an income tax payer – No other pensions – Not owning 4-wheeler with >1000cc engine – Age ≥ 60 years – Kerala resident for ≥ 3 years – Not receiving other pensions |

| Indira Gandhi National Old Age Pension (Over 75 Years) | ₹1500 | – Family income ≤ ₹1 lakh – No other social welfare pension – Not an income tax payer – Not receiving other pensions – Not owning 4-wheeler with >1000cc engine – Age ≥ 75 years – Kerala resident for ≥ 3 years – Not receiving other pensions |

| Indira Gandhi National Disability Pension (80% Disabled) | ₹1500 | – No age limit- No service pension – Disability certificate – No salary/pension from govt. – Not owning 4-wheeler with >1000cc engine – No inmate of Agati Mandir – Family income ≤ ₹1 lakh – No other pensions – Not receiving other pensions |

| Indira Gandhi National Disability Pension | ₹1500 | – No age limit – Disability certificate – No service pension – No salary/pension from govt. – Not owning 4-wheeler with >1000cc engine – No inmate of Agati Mandir – Family income ≤ ₹1 lakh- No other pensions – Not receiving other pensions |

| Pension for Unmarried Women above 50 Years of Age | ₹1500 | – Age ≥ 50 years – Family income ≤ ₹1 lakh – Not a service pensioner – Unmarried – Not an income tax payer – Not receiving other pensions |

| Indira Gandhi National Widow Pension Scheme | ₹1500 | – Age ≥ 18 years – Family income ≤ ₹1 lakh – Not a service pensioner – Widow – Not an income tax payer – Not receiving other pensions |

Applying for Sevana Pension

Applying for Sevana Pension involves a straightforward process:

- Access the Official Portal: Visit the official Sevana Pension Scheme website to access crucial information and application forms.

- Download and Complete Application: Download the relevant application form, duly fill it with accurate details, and attach necessary documents.

- Submission: Submit the application form alongside supporting documents to the designated local body or municipality within the stipulated timeframe.

- Review and Approval: The submitted applications undergo scrutiny by concerned authorities, following which eligible candidates receive due approval.

Accessing Information and Records

Beneficiaries and the public can conveniently access information related to the Sevana Pension Scheme:

- Pension Search: Interested parties can search for pension-related information based on category and criteria on the official portal.

- DBT Records and Reports: The scheme’s Direct Benefit Transfer (DBT) records, government orders, and reports are readily accessible for viewing and download.

- E-Filing and Survey: The portal offers options for e-filing applications and participating in surveys, enhancing transparency and efficiency.

Contact and Support

For any queries or assistance, individuals can reach out to the Sevana Pension Scheme’s dedicated helpline via provided contact details. The helpline is committed to addressing concerns and ensuring a seamless experience for applicants and beneficiaries.

Sevana Pension 2023 stands as a testament to the Kerala government’s commitment to social welfare. By extending financial aid to marginalized sections of society, the scheme not only empowers individuals but also contributes to building a more inclusive and equitable society. As Kerala continues its journey towards comprehensive social development, Sevana Pension remains a cornerstone of support for those in need.

FAQs

1. What is Sevana Pension 2023?

Sevana Pension 2023 is a significant initiative introduced by the Government of Kerala to provide financial assistance and support to various marginalized segments of society. The scheme offers monthly pensions to specific demographics, such as agricultural laborers, elderly citizens, disabled individuals, unmarried women above 50 years, and widows.

2. How does Sevana Pension work?

Sevana Pension aims to empower economically weaker sections by granting monthly pensions. The scheme encompasses different pension categories, each catering to a specific group. Eligible individuals can apply through online or offline modes, and once approved, they receive a monthly pension amount of ₹1500.

3. What are the key features of Sevana Pension?

Sevana Pension is characterized by several key features, including:

- Monthly pension amount of ₹1500

- Five distinct pension categories

- Availability for various marginalized demographics

- Online and offline application options

- Administration by the Department of Social Welfare and the Department of Labor

4. Who is eligible for Sevana Pension?

Eligibility criteria vary based on the pension category. Generally, criteria include factors such as age, family income, residency, disability status, and existing pensions. For example, agricultural workers must have a family income of ≤ ₹1 lakh, be aged ≥ 60 years, and fulfill other specified conditions.

5. How can I apply for Sevana Pension?

To apply for Sevana Pension, follow these steps:

- Visit the official Sevana Pension Scheme website

- Download the relevant application form

- Fill in accurate details and attach necessary documents

- Submit the application to the designated local body or municipality

- Await review and approval

6. Can I check the status of my Sevana Pension application?

Yes, you can check the status of your application by using the pension search feature on the official Sevana Pension Scheme website. This allows you to track the progress of your application based on category and criteria.

7. What documents are required for the Sevana Pension application?

Proof of age, income, residency, disability (if applicable), and other pertinent certifications may be among the papers needed. Reviewing the exact documentation needs for the pension category you’re applying for is crucial.

8. How is the pension amount disbursed?

Following the approval of your application, the Direct Benefit Transfer (DBT) system deposits the authorized pension amount into your bank account.

9. Can I apply for more than one pension category under Sevana Pension?

No, you can apply for only one pension category that matches your eligibility criteria. Each pension category is designed for specific demographics, and applicants are expected to apply for the most relevant category.

10. How does Sevana Pension contribute to social development?

By offering financial assistance to those who are socially and economically deprived, Sevana Pension significantly contributes to social development. It lessens their need on outside assistance, encourages self-sufficiency, and helps to create a society that is more inclusive and egalitarian.

11. What is the role of local bodies and municipalities in Sevana Pension?

Local bodies and municipalities are responsible for processing applications, conducting necessary verifications, and disbursing pensions to eligible beneficiaries within their jurisdictions.

12. Where can I find more information about Sevana Pension?

On the website for the Sevana Pension Scheme, you may discover additional data about the Sevana Pension, along with application forms, instructions, and contact information. For any questions or support, you may also call the special hotline.

13. Is Sevana Pension available only to residents of Kerala?

Yes, Sevana Pension is specifically for residents of Kerala who meet the eligibility criteria outlined for each pension category.

14. Can I apply for Sevana Pension if I already receive another type of pension?

Eligibility criteria vary, but in many cases, individuals already receiving certain types of pensions may not be eligible for Sevana Pension. It’s essential to review the specific criteria for each pension category.

15. How is Sevana Pension contributing to the overall welfare of marginalized sections in Kerala?

Sevana Pension serves as a crucial support system for marginalized sections by providing a steady source of income. It encourages financial independence, gives people the ability to satisfy their basic necessities, and improves their general wellbeing.

Ahaa, its nice discussion about this article at this place at this website, I have read all

that, so at this time me also commenting at this place.